Double materiality requires companies to disclose both the financial impacts of sustainability issues on their business and how their operations affect the environment and society. This approach ensures comprehensive transparency by capturing business risks and opportunities as well as broader environmental and social impacts.

EFRAG’s IG 1 Materiality Assessment provides comprehensive guidance on implementing this concept, helping organizations understand and disclose the dual perspectives of sustainability impacts.

Understanding the EFRAG IG 1 Materiality Assessment

The EFRAG IG 1 Materiality Assessment Implementation Guidance (MAIG) serves as a critical resource for organizations striving to adhere to the European Sustainability Reporting Standards (ESRS). It outlines a systematic approach to assessing materiality, ensuring that sustainability reports reflect both the impact of the organization on its surroundings and the financial implications of these impacts.

Key Components of Double Materiality

Impact Materiality:

Impact materiality focuses on how an organization’s activities affect the environment and society.

The EFRAG IG 1 guidance breaks this down into several key steps:

- Identification of Impacts: Organizations need to identify actual and potential impacts across their value chain, including upstream and downstream activities.

- Severity Assessment: Impacts are assessed based on their scale (how grave the impact is), scope (how widespread the impact is), and irremediable character (the extent to which the impact can be mitigated or reversed).

- Stakeholder Engagement: Engaging with stakeholders, including those directly affected by the organization’s activities, is crucial for understanding the full extent of impacts.

- Setting Thresholds: Organizations must set quantitative and qualitative thresholds to determine which impacts are material and require reporting.

Financial Materiality:

Financial materiality, on the other hand, addresses how sustainability issues affect the organization’s financial performance.

Key aspects include:

- Identification of Risks and Opportunities: Organizations must identify sustainability-related risks and opportunities that could impact their financial health.

- Assessment of Financial Effects: This involves evaluating the likelihood and magnitude of these risks and opportunities, considering factors such as financial position, cash flows, and access to capital.

- Integration with Financial Reporting: The findings from the financial materiality assessment should be integrated into the organization’s overall financial disclosures, ensuring consistency and transparency.

Practical Steps for Implementing Double Materiality

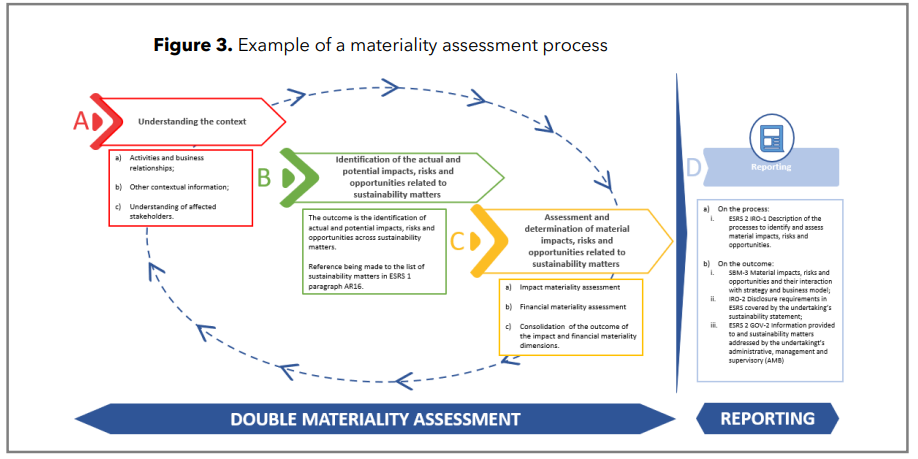

Step A: Understanding the Context

Organizations should start by developing a thorough understanding of their operations, business relationships, and the broader environmental and social context in which they operate.

This includes:

- Analyzing business plans, strategies, and financial statements.

- Mapping out the value chain, identifying key stakeholders and their concerns.

- Reviewing legal and regulatory landscapes and relevant sustainability trends.

Step B: Identifying Impacts, Risks, and Opportunities

In this step, organizations compile a comprehensive list of potential impacts, risks, and opportunities related to sustainability matters.

This involves:

- Using the list of sustainability matters provided in ESRS.

- Leveraging internal processes like due diligence and risk management.

- Engaging with stakeholders to gather insights on potential impacts.

Step C: Assessing and Determining Materiality

This critical step involves applying criteria for both impact and financial materiality to determine which issues are material:

- Impact Materiality: Assess impacts based on severity (scale, scope, irremediable character) and likelihood.

- Financial Materiality: Evaluate risks and opportunities based on their potential financial effects, considering performance, position, cash flows, and cost of capital.

Step D: Reporting

Finally, organizations report the outcomes of their materiality assessment:

- Process Description: Disclose the methodologies and criteria used in the materiality assessment.

- Material IROs: Report on identified material impacts, risks, and opportunities, explaining their significance and how they influence the organization’s strategy and business model.

Visual Aids from EFRAG Guidance

To enhance understanding, EFRAG’s IG 1 Materiality Assessment includes several visual aids, such as:

Figure 1(a): Double Materiality Scope

This figure illustrates the overlap and interplay between impact and financial materiality. It helps organizations visualize how their activities can simultaneously impact society and the environment, while also influencing their financial performance.

Figure 1(b): Relationship with Business Model

This figure shows how materiality assessments integrate with the organization’s strategy and business decisions. It highlights the importance of aligning sustainability impacts with business goals to ensure coherent and effective reporting.

Figure 3: Example of a Materiality Assessment Process

This figure outlines a practical example of a materiality assessment process, guiding organizations through understanding context, identifying impacts, assessing materiality, and reporting. It emphasizes a structured approach to ensure comprehensive and accurate sustainability reporting.

Figure 4: Impact Severity Assessment

A graphical representation of how to map impacts based on severity criteria, this figure provides a clear method for organizations to assess and prioritize their sustainability impacts based on scale, scope, and irremediability.

The Importance of Implementing Double Materiality

Implementing double materiality is crucial for comprehensive and transparent sustainability reporting. EFRAG’s IG 1 Materiality Assessment offers detailed guidance to help organizations navigate this complex process, ensuring that their sustainability reports accurately reflect both their environmental and societal impacts and the financial implications thereof.

You can find EFRAG’s IG 1 Materiality Assessment Implementation Guidance here.

We invite you to join our vibrant ESG community, a collective force driving positive change. This is your opportunity to be part of a dynamic network where knowledge, best practices, and innovative ideas are shared freely, empowering you to make impactful decisions.

Together, we can amplify our efforts to shape a sustainable future.